Nasdaq

2024 - 8 - 3When Nasdaq Goes Down, Who You Gonna Call? E-Ticket to Market Mayhem!

Amazon - Investors - Nasdaq - Recession - Stock Market - Tech EarningsIs your portfolio taking a nosedive? The Nasdaq's drop is the talk of the town! Here’s everything you need to know about the latest Wall Street rollercoaster. 🎢📉

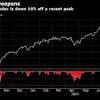

The financial markets saw a wild ride last Friday as the Nasdaq Composite Index faced a whopping 3% drop amidst fears of a recession and dismal tech earnings. Investors were already jittery from previous economic indicators, but when Amazon reported a staggering fall in its Q2 revenue, it was like tossing a lit firecracker into a pack of fire ants. You could practically hear the collective gasp of disbelief from Wall Street, as stocks slid with no sign of a safety net.

Amidst this cacophony of economic uncertainty, the Dow Jones wasn't doing any better. It lost more than 700 points, causing some to question if their portfolios were turning into modern-day scarecrows! Many were watching the July job report—which was weaker than expected—with a blend of apprehension and dread. It turns out the jobs report acted more like an underwater volcano than a gentle breeze, as the fear of recession took center stage in this gripping financial drama.

Connecting the dots, we see that even the bright lights of the tech-heavy Nasdaq were dimmed by a violent rotation of investors fleeing from Big Tech stocks. Even the sensation around AI-darling stocks couldn’t shield them from the meltdown. The Nasdaq 100 Index slipped into correction territory, wiping out over $2 trillion in value. For those keeping score at home, that’s a lot of cash! Who knew a tech revolution could take a detour into a dark valley so swiftly?

Despite the grim numbers, this market chaos is part of a larger show that’s both thrilling and terrifying. Who can forget that Amazon, once the star of the stock market, is now doing its best impression of a rollercoaster? It all leads back to the cyclical nature of the market, where the highs and lows continue to paint a picture of uncertainty. Tighten your seatbelts, Singapore—this financial ride is far from over!

Insmed Reports Inducement Grants Under NASDAQ Listing Rule ... (PRNewswire)

PRNewswire/ -- Insmed Incorporated (Nasdaq: INSM), a global biopharmaceutical company on a mission to transform the lives of patients with serious and rare.

Equities sell off, Nasdaq down 3%, bond yields sink (Reuters.com)

Global equities sold off on Friday and U.S. Treasury yields were at multi-month lows on concerns about the economy and downbeat forecasts from Amazon and ...

Nasdaq Futures Tumble on Weak U.S. Tech Earnings and Growth ... (Nasdaq)

Amazon (AMZN) slumped over -9% in pre-market trading after the e-commerce and cloud giant reported weaker-than-expected Q2 revenue and issued disappointing Q3 ...

Dow loses more than 700 points as recession fears dent Wall Street ... (CNBC)

Stocks slid Friday as a much weaker-than-anticipated jobs report for July ignited worries that the economy could be falling into a recession.

Dow Jones, Nasdaq Plunge As Jobs Report Adds To Investor ... (Investor's Business Daily)

Stocks continued their sell-off Friday morning as July jobs numbers rattled investors with fears of a recession. Among the big losers was Amazon.com (AMZN), ...

Wall Street Losses Deepen As Nasdaq Drops 3% (Barron's)

Wall Street stocks dropped further into the red on Friday following weak US jobs data, with the Nasdaq index falling as much as three percent.

Stock Market Today: Dow Drops 850 Points, Nasdaq Eyes ... (The Wall Street Journal)

Follow along for live updates on stocks, bonds and markets, including the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite.

Dow, S&P 500, Nasdaq have worst session since 2022 (Fox Business)

U.S. stocks tumbled as recession fears spooked investors following a series of weak economic reports this week, including the July jobs report released ...

Tech-heavy Nasdaq sinks into correction zone as equity selloff ... (Yahoo Finance)

(Reuters) -Worries over tech earnings and a slowing U.S. economy slammed the Nasdaq Composite Index on Friday, putting it on track for a 10% decline from ...

Nasdaq set to confirm correction as recession fears mount; Amazon ... (Reuters)

The Nasdaq Composite was on track to fall into a correction in a Wall Street battering after Friday's weak jobs numbers deepened worries of a slowdown in ...

Nasdaq 100 is in correction territory with AI darlings sinking (BNN)

The violent rotation from Big Tech plunged the Nasdaq 100 Index into correction territory, wiping out more than US$2 trillion in value in just over three ...

Tech-heavy Nasdaq sinks into correction zone as equity selloff ... (Reuters)

Worries over tech earnings and a slowing U.S. economy slammed the Nasdaq Composite Index on Friday, putting it on track for a 10% decline from its early ...

Nasdaq 100 Is in Correction Territory With AI Darlings Sinking (Yahoo Finance)

(Bloomberg) -- The violent rotation from Big Tech plunged the Nasdaq 100 Index into correction territory, wiping out more than $2 trillion in value in just ...

Nasdaq falls 10% from record high confirming Big Tech correction ... (The Economic Times)

The Nasdaq Composite index fell 2.2% on Friday, putting it on track to confirm it is in a correction following concerns about pricey Big Tech valuations and ...

wall street today: Dow slumps 459 pts, Nasdaq on pace to confirm ... (Economic Times)

The S&P 500 reached its lowest point since July 11th, and the Dow Jones Industrial Average faced its most significant two-day decline since March 2023.

Nasdaq on course to confirm correction as recession fears mount (Livemint)

US labor growth misses expectations; unemployment rate rises. *. Bets rise for a 50 basis point Fed rate cut in September.

Tech stocks plunge as Nasdaq enters correction territory (The Washington Post)

After multiple Big Tech firms disappointed on earnings, the Nasdaq composite index fell further and is now down more than 10 percent from the record it set ...

S&P 500, Dow, Nasdaq slide after weak jobs report triggers ... (USA TODAY)

All three major stock indices slid as a weak jobs report triggers recession fears. Economists now see more aggressive Fed rate cuts this year.

Nasdaq on track to enter correction territory as recession fears slam ... (MarketWatch)

Friday's stock-market pullback has the tech-heavy Nasdaq Composite and even more megacap-tech-concentrated Nasdaq-100 on track to enter correction territory ...

Innoviz Announces Receipt of Nasdaq Non-Compliance Letter (PRNewswire)

PRNewswire/ -- Innoviz Technologies Ltd. (Nasdaq: INVZ) (the "Company" or "Innoviz"), a leading Tier-1 direct supplier of high-performance, automotive-grade ...

Nasdaq Enters Correction As Jobs Report Fuels Massive Stock Selloff (Forbes)

The Dow fell 610 points (1.5%) as the S&P 500 and Nasdaq dropped 1.8% and 2.4%, respectively, as trading closed. The Nasdaq entered correction territory after ...

Tech-heavy Nasdaq sinks into correction zone as equity selloff ... (CNA)

Worries over tech earnings and a slowing U.S. economy slammed the Nasdaq Composite Index on Friday, putting it on track for a 10 per cent decline from its ...

Tech-heavy Nasdaq in correction as equity sell-off deepens (The Business Times)

WORRIES over tech earnings and a slowing US economy slammed the Nasdaq Composite index on Friday (Aug 2) as it extended recent declines to fall 10 per cent ...

Stocks drop, Nasdaq confirms correction as recession fears mount (New Straits Times Online)

NEW YORK: U.S. stocks sold off for a second straight session on Friday, and the Nasdaq Composite confirmed it was in correction territory after a soft jobs ...

Nasdaq 100 Is in Correction Territory With AI Darlings Sinking (Bloomberg)

The violent rotation from Big Tech plunged the Nasdaq 100 Index into correction territory, wiping out more than $2 trillion in value in just over three ...

Nasdaq enters correction territory as recession fears slam stocks (Morningstar.com)

By William Watts. Friday's stock-market pullback saw the tech-heavy Nasdaq Composite and even more megacap-tech-concentrated Nasdaq-100 enter correction ...

Stock Market News From Aug. 2, 2024: Why the Stock Market Is ... (Barron's)

The Nasdaq Composite was at risk at closing in correction territory for the first time since last fall. The tech-heavy index was down 3.5% to 16592.34.

Explore the last week

- 2024 - 12 - 21, 2 topics across 40 articles.

- 2024 - 12 - 20, 17 topics across 165 articles.

- 2024 - 12 - 19, 19 topics across 202 articles.

- 2024 - 12 - 18, 13 topics across 197 articles.

- 2024 - 12 - 17, 15 topics across 170 articles.

- 2024 - 12 - 16, 23 topics across 297 articles.

- 2024 - 12 - 15, 7 topics across 88 articles.